You’re working 60+ hour weeks. Your phone buzzes constantly with questions from your team. Revenue is up, but somehow you feel poorer than ever.

You can’t take a vacation. You can’t step away for a day. Your business has become a prison of your own making.

Business systemization expert David Jenyns, founder of SYSTEMology, calls this the “owner dependency trap.” It’s one of nine critical threats that can destroy even profitable companies.

Business owners across every industry hit this ceiling where growth feels like quicksand rather than momentum. The business demands more hours, generates more problems, and somehow produces less profit.

The difference between businesses that successfully navigate crisis and those that disappear forever comes down to recognizing these threats early. With a proven recovery framework, companies can transform from failing enterprises into thriving, sustainable operations.

This guide reveals the nine most dangerous business killers, along with the recovery framework used by successful turnaround specialists. You’ll discover how to diagnose which threats are attacking your business, implement immediate stabilization measures, and build systems that prevent future crises.

What’s in this article:

Understanding Business Turnaround

The 9 Business Killers

Killer #1: Low Market Demand

Killer #2: Inability to Reach Target Market

Killer #3: Lack of Competitive Differentiation

Killer #4: Not Managing by the Numbers

Killer #5: Inadequate Margins

Killer #6: Insufficient Working Capital

Killer #7: Lack of Innovation

Killer #8: Weak Business Systems

Killer #9: Ineffective Management

The Business Turnaround Framework

Phase 1: Rapid Assessment and Stabilization

Phase 2: Strategic Realignment and Systems Building

Phase 3: Growth and Optimization

FAQ Section

Taking Action on Your Business Turnaround

Understanding Business Turnaround

A business turnaround is when you take a failing company and transform it into something that actually works again. Not just band-aid fixes. Real change.

The key distinction lies between temporary setbacks and systematic failure.

Temporary setbacks might include losing a major client, facing seasonal downturns, or dealing with supply chain disruptions. These challenges, while serious, don’t necessarily threaten the fundamental viability of your business model.

Systematic failure occurs when multiple core functions break down simultaneously. Problems compound over time.

Warning signs of systematic failure include consistently declining revenues across multiple quarters, inability to meet basic financial obligations, high employee turnover in key positions, and repeated operational crises that consume management attention.

When these indicators appear together, you’re likely facing a situation that requires full business turnaround intervention rather than simple course corrections.

The 9 Business Killers: Critical Threats to Your Company’s Survival

Sales and Market Position Killers

Killer #1: Low Market Demand

The foundation of any successful business is sufficient customer demand for your products or services.

When demand erodes, even the most efficient operations and strongest financial positions cannot sustain long-term viability. Low market demand typically stems from several underlying problems that require different intervention strategies.

Product-market fit failures occur when your offering doesn’t solve meaningful customer problems or provides insufficient value compared to available alternatives. This often happens when markets evolve faster than product development cycles, leaving companies with outdated solutions that no longer resonate with customer needs.

Are customers actively seeking solutions like yours, or do you need to convince them they have a problem?

Blockbuster Video serves as a classic example. The company’s physical rental model became obsolete as customers shifted to Netflix’s mail delivery and eventually streaming services.

Market saturation presents another demand challenge, particularly in mature industries where customer acquisition becomes increasingly expensive and competitive. When too many companies chase the same customer base with similar offerings, price competition intensifies and profit margins compress to unsustainable levels.

To diagnose demand problems, ask yourself these critical questions:

- Are customers actively seeking solutions like yours, or do you need to convince them they have a problem?

- How often do prospects choose to do nothing rather than purchase from you or competitors?

- Are customers willing to pay premium prices for superior solutions, or do they view your category as a commodity?

Early intervention strategies for demand issues include conducting deep customer research to understand evolving needs, testing new value propositions with existing customers, and exploring adjacent markets where your capabilities might address different problems more effectively.

Killer #2: Inability to Reach Target Market

Having great products means nothing if potential customers can’t find you or don’t know you exist.

In today’s fragmented media landscape, reaching target customers cost-effectively has become increasingly challenging for businesses of all sizes.

Traditional marketing channels often prove ineffective for smaller companies competing against larger competitors with substantial advertising budgets.

Physical location problems compound these challenges for retail and service businesses, while online businesses struggle with search engine optimization (SEO), social media algorithm changes, and rising digital advertising costs.

The modern solution requires a multi-channel approach that combines digital marketing excellence with relationship-building strategies.

SEO ensures potential customers find you when searching for solutions to their problems. Content marketing establishes your expertise and builds trust before customers are ready to purchase. Social media engagement creates communities around your brand and generates word-of-mouth referrals.

However, the most sustainable customer acquisition strategy involves creating systems that turn existing customers into active referral sources.

This requires delivering exceptional experiences that customers want to share, implementing formal referral programs that reward advocacy, and maintaining ongoing relationships that generate repeat business and expansion opportunities.

Killer #3: Lack of Competitive Differentiation

Competition destroys businesses in two ways: either competitors offer genuinely superior value, or your business fails to stand out from the pack.

When customers consistently choose alternatives, it’s rarely about price alone. Successful competitors win by providing solutions that justify premium pricing through better value, convenience, or experience.

But the more common killer is businesses that fail to differentiate at all. Without clear differentiation, you’re condemned to price competition. Only the lowest-cost provider can sustainably profit in that environment.

Change the game entirely by redefining what customers value most.

When businesses offer similar products, similar service, and similar pricing to everyone else in their market, customers see no meaningful difference. The default decision becomes “whoever costs less.”

Successful differentiation requires understanding what customers truly value, then delivering those benefits in ways competitors cannot easily copy.

This might come from operational excellence through systems. When Ryan Stannard’s Stannard Family Homes implemented SYSTEMology, documented systems meant consistent quality across projects. That systematic reliability became a market differentiator that’s difficult for competitors to replicate.

Or from specialized expertise. Gary McMahon’s Ecosystem Solutions operates in the highly specialized niche of ecological consulting. This narrow focus allowed deep expertise that generalist competitors couldn’t match.

Or innovative business models. Costco differentiates through membership-based bulk purchasing. Amazon initially differentiated through convenience and selection.

Your unique selling proposition should be specific, meaningful to customers, and difficult for competitors to replicate quickly. Avoid generic claims like “better quality” or “great service” that every company makes.

The goal isn’t to beat competitors at their own game. It’s to change the game entirely by redefining what customers value most.

Financial and Cash Flow Killers

Killer #4: Not Managing by the Numbers

What gets measured gets managed is a crucial note for struggling businesses.

Without clear visibility into key performance indicators, business owners operate blindly, making decisions based on intuition rather than data-driven insights.

Financial statements show you what already happened. But turnarounds need metrics that tell you what’s coming next.

Sales pipeline metrics, customer acquisition costs, lifetime value calculations, and operational efficiency measures provide early warning signals that enable proactive intervention before problems become crises.

Modern dashboard technology makes it easier than ever to track critical business metrics in real-time. However, the key lies in identifying which metrics actually drive business performance rather than simply monitoring everything that can be measured. Focus on 5-7 key indicators that directly correlate with revenue growth, profitability, and cash flow generation.

Turnarounds need metrics that tell you what’s coming next.

The most important financial metrics for turnaround situations include gross profit margins by product line, monthly recurring revenue trends, customer acquisition cost versus lifetime value ratios, accounts receivable aging, and burn rate calculations.

These indicators reveal whether your business model is fundamentally sound and whether current operations can generate sustainable profits.

Regular financial analysis should become a weekly habit rather than a monthly or quarterly exercise. This frequency enables rapid response to negative trends while they can still be corrected through operational adjustments rather than dramatic restructuring.

Killer #5: Inadequate Margins

Healthy profit margins provide the financial cushion necessary to weather unexpected challenges.

They enable investment in growth opportunities. They build sustainable competitive advantages.

When margins compress below sustainable levels, businesses enter survival mode. Every decision focuses on short-term cash preservation rather than long-term value creation.

Margin compression typically results from pricing pressure, cost inflation, or operational inefficiency. Pricing pressure occurs when competitors undercut your prices or when customers view your category as a commodity. Cost inflation happens when suppliers raise prices faster than you can pass increases to customers. Operational inefficiency wastes resources through poor processes, overstaffing, or technology failures.

The solution often requires simultaneous action across multiple areas.

Pricing strategies should focus on value-based approaches that justify premium positioning rather than competing solely on cost. This might involve bundling products and services, creating premium service tiers, or targeting customer segments that prioritize quality over price.

Cost reduction efforts should target waste elimination rather than across-the-board cuts that might damage revenue-generating capabilities. Analyze your cost structure to identify non-essential expenses, negotiate better terms with suppliers, and implement technology solutions that improve productivity without sacrificing quality.

Revenue diversification can also improve overall margins by reducing dependence on low-margin products or services.

Look for opportunities to add higher-value services, create recurring revenue streams, or develop products that command premium pricing due to specialized features or superior performance.

Killer #6: Insufficient Working Capital

Cash flow problems kill profitable businesses faster than any other single factor.

Even companies with strong sales and healthy margins can fail if they cannot generate sufficient cash to meet payroll, purchase inventory, and cover operating expenses during normal business cycles.

Working capital challenges typically stem from rapid growth that outpaces cash generation. Seasonal business patterns create temporary cash shortages. Poor management of accounts receivable and inventory levels drains resources.

Cash flow problems kill profitable businesses faster than any other single factor.

Growth-related cash crunches occur when companies must invest in inventory and staffing before receiving payment from new customers.

Effective working capital management requires detailed cash flow forecasting. Project receipts and expenditures at least 13 weeks into the future. This visibility enables proactive management of cash resources through techniques like invoice factoring, inventory optimization, and payment term negotiations with suppliers.

Alternative financing options have expanded significantly beyond traditional bank loans.

Invoice factoring provides immediate cash for outstanding receivables. Equipment financing preserves working capital while enabling necessary technology upgrades. Revenue-based financing offers flexible repayment terms tied to actual business performance rather than fixed monthly payments.

The goal isn’t to eliminate all debt or financing relationships but to ensure adequate liquidity for normal operations while maintaining financial flexibility for unexpected opportunities or challenges.

Operational Excellence Killers

Killer #7: Lack of Innovation

Companies that stop innovating inevitably fall behind competitors who continuously improve their products, services, and business processes.

Innovation doesn’t necessarily require breakthrough technological advances or massive research and development investments. Often, the most effective innovations involve incremental improvements to existing offerings, creative applications of proven technologies, or new business models that serve existing customers more effectively.

The key to sustainable innovation lies in creating systematic processes that generate, evaluate, and implement new ideas regularly.

This might involve formal suggestion programs that reward employee contributions, regular customer feedback sessions that identify unmet needs, or competitive analysis that reveals market gaps your company could fill.

Digital transformation represents a critical innovation opportunity for most businesses. This doesn’t mean adopting every new technology trend but rather identifying specific digital tools that can improve customer experience, reduce operational costs, or create new revenue streams.

Customer relationship management systems, automated marketing platforms, and data analytics tools often provide immediate returns on investment while building capabilities for future growth.

Innovation culture requires leadership commitment to experimentation and learning from failure.

Companies that punish failed experiments discourage the risk-taking necessary for breakthrough improvements. Instead, celebrate intelligent failures that provide valuable learning while doubling down on successful innovations that create competitive advantages.

Killer #8: Weak Business Systems

David Jenyns defines business systems as “the documented processes, procedures, and workflows that enable consistent execution across all company functions.”

According to Jenyns’ research with hundreds of businesses through his SYSTEMology methodology, companies without documented systems face three dangerous vulnerabilities:

- Key employee departures can cripple operations if critical knowledge exists only in individual minds.

- Quality inconsistencies damage customer relationships when different team members handle similar situations differently.

- Scaling becomes impossible when growth requires proportional increases in management oversight rather than systematic execution.

Ryan Stannard, founder of Stannard Family Homes in Adelaide, experienced this firsthand. His custom home building company was stuck at the $2-4 million revenue mark. Why?

“I was in here day to day answering questions,” Ryan recalls. The constant “Ryan, how do I…?” questions meant he couldn’t step away. He couldn’t grow.

Documentation alone isn’t sufficient. Systems must be actively used, regularly updated, and continuously improved

Using the SYSTEMology framework, Ryan documented core processes and trained team members to follow systematic approaches rather than relying on tribal knowledge.

The result? His business grew to $15 million.

More importantly, he can now take seven weeks off over summer.

The wheels keep turning.

His daughter Eryn rose from selections to assistant manager by rewriting and running the playbook as their Systems Champion.

Effective business systems documentation should cover all critical processes. This includes sales methodology, customer service protocols, quality control procedures, financial management practices, and employee training programs.

However, documentation alone isn’t sufficient. Systems must be actively used, regularly updated, and continuously improved based on real-world experience.

The most successful system implementation starts with identifying your company’s core value-creating processes. Document current best practices. This approach captures existing knowledge while providing a foundation for systematic improvement.

Once documented, systems should be tested with new team members to ensure clarity and completeness.

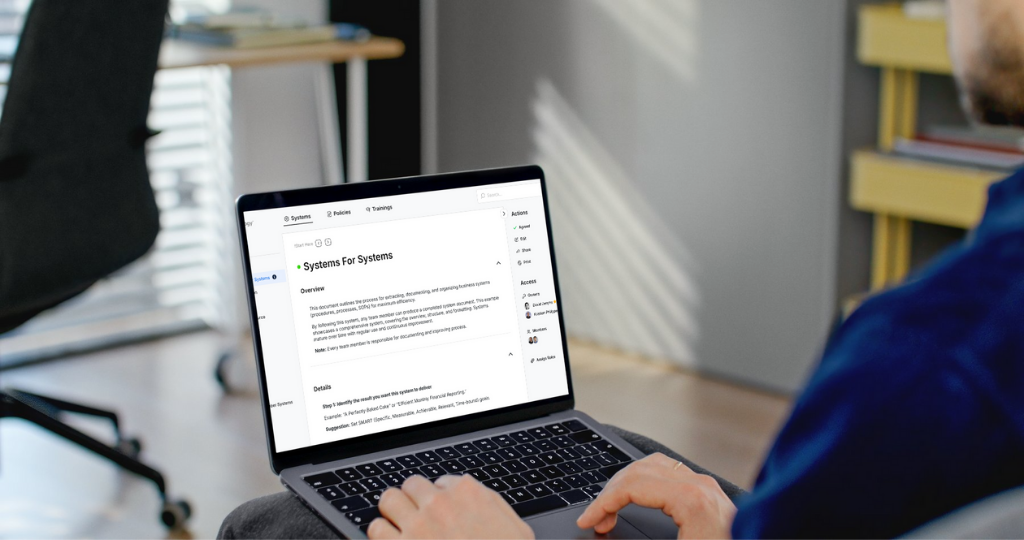

Modern system organization requires more than traditional paper manuals gathering dust on shelves. Cloud-based platforms like systemHUB provide centralized access to all documented processes. They enable real-time updates. Team members can quickly find the information they need.

The goal is creating a culture where “I didn’t know how” becomes “Let me check the system.”

Technology can significantly enhance system effectiveness through automation, workflow management, and performance tracking. Customer relationship management platforms ensure consistent sales processes. Project management tools coordinate complex activities across multiple team members. Quality management systems prevent errors while documenting corrective actions for continuous improvement.

Killer #9: Ineffective Management

Leadership failures can destroy otherwise healthy businesses by creating cultural dysfunction, strategic confusion, and operational chaos.

Ineffective management manifests through poor decision-making, inadequate communication, lack of accountability, and inability to develop team capabilities.

The most dangerous management failure involves micromanagement combined with poor delegation. When leaders try to control every detail while failing to develop team member capabilities, they create bottlenecks that limit organizational capacity while preventing skill development that could reduce their workload.

Successful turnaround leadership requires balancing urgency with systematic thinking.

Crisis situations demand rapid decisions and immediate action, but sustainable recovery requires building systems and capabilities that prevent future crises. The best leaders can shift between tactical firefighting and strategic planning based on current priorities.

Building management effectiveness starts with honest self-assessment of leadership strengths and weaknesses. Many business owners excel at entrepreneurial skills like vision creation and problem-solving but struggle with operational management tasks like performance measurement and team development.

Recognizing these gaps enables targeted skill development or strategic hiring to fill capability voids.

The most effective management teams combine complementary skills rather than trying to develop identical capabilities across all leaders.

Visionary leaders need detail-oriented managers. Creative problem-solvers need systematic implementers. Sales-focused leaders need operations-minded partners. This diversity creates stronger decision-making while reducing the risk of blind spots that can derail recovery efforts.

The Business Turnaround Framework: Your Recovery Roadmap

Phase 1: Rapid Assessment and Stabilization (Days 1-30)

Successful business turnaround begins with a clear-eyed look at your current situation.

Follow this with immediate actions to stop the bleeding and stabilize operations. This phase requires moving quickly while gathering sufficient information to make informed decisions about longer-term strategy.

Start with a comprehensive financial analysis that identifies your true cash position, immediate obligations, and minimum operating requirements. Calculate your daily cash burn rate and determine how long current resources will sustain operations without additional revenue or financing.

This analysis provides the timeline for all subsequent turnaround activities.

Conduct rapid customer interviews to understand why sales are declining or why customers might be choosing alternatives. These conversations often reveal problems that aren’t obvious from internal analysis while identifying opportunities for quick wins that can generate immediate revenue improvements.

Successful business turnaround begins with a clear-eyed look at your current situation.

Stakeholder communication becomes critical during this phase.

Employees need honest updates about company challenges while receiving reassurance about leadership commitment to recovery. Vendors may require renegotiated payment terms or extended credit arrangements. Customers need confidence that you’ll continue delivering promised products and services.

The goal of stabilization isn’t to solve all problems but to buy time for systematic recovery while preventing further deterioration.

This might involve temporary cost reductions, emergency financing arrangements, or rapid implementation of critical systems that prevent operational breakdowns.

Phase 2: Strategic Realignment and Systems Building (Days 31-90)

Once immediate threats are contained, focus shifts to addressing the underlying issues of business decline.

You’ll build capabilities for sustainable growth. This phase requires balancing short-term performance improvements with longer-term investments in systems and capabilities.

Strategic realignment starts with revisiting your core value proposition. Ensure it addresses real customer needs in ways that differentiate you from competitors. This might involve adjusting product features, modifying service delivery, or targeting different customer segments that value your unique capabilities more highly.

System implementation should prioritize processes that directly impact customer satisfaction and financial performance.

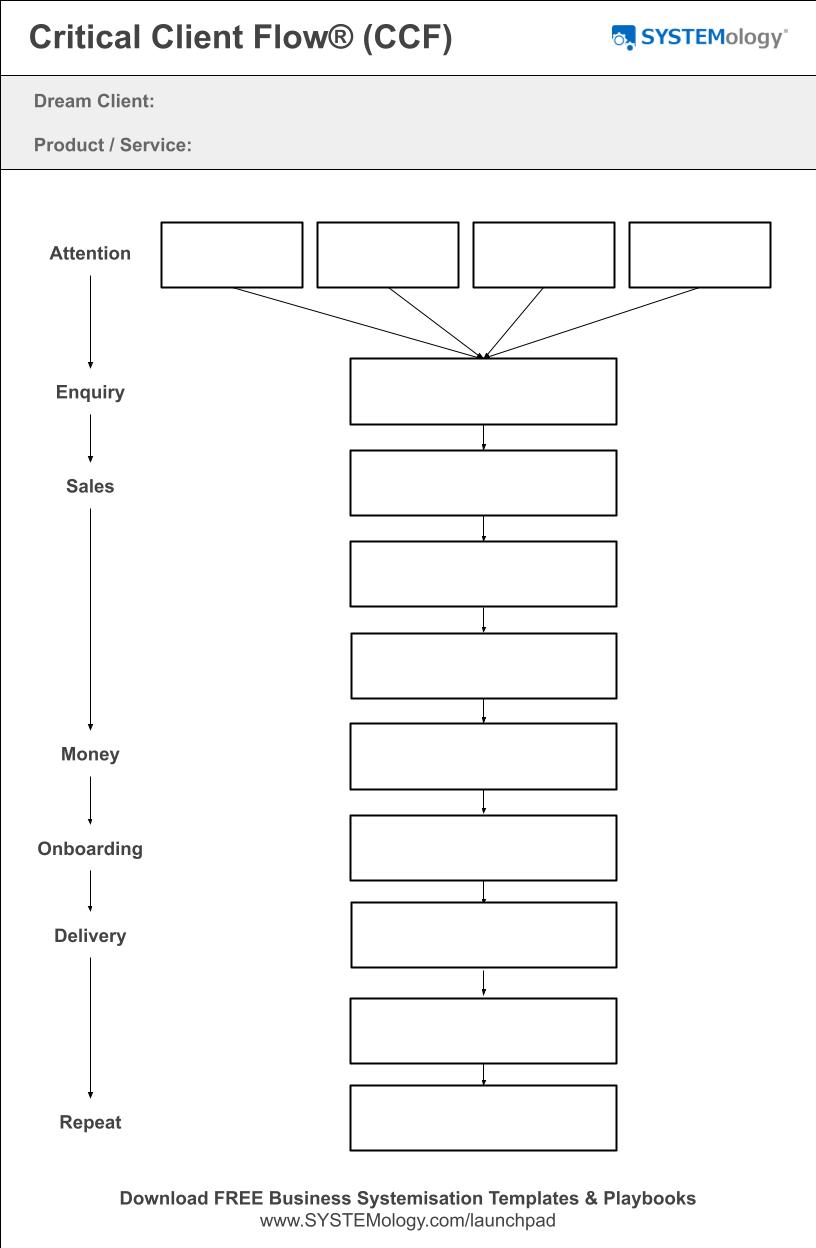

According to the SYSTEMology framework, businesses should focus on documenting their Critical Client Flow first. This is the journey one primary customer takes with one primary product from first contact to final delivery.

Sales systems ensure consistent customer acquisition and relationship management. Financial systems provide the visibility and controls necessary for sustainable profitability. Operational systems eliminate waste while improving quality and delivery reliability.

The most effective approach involves appointing a dedicated team member as a Systems Champion. This person coordinates documentation efforts across departments while ensuring consistency in how processes are captured and organized.

Renee Kelly, founder of Lime Therapy, found her Systems Champion in an unexpected place. Kaleb Grant, a young occupational therapist who’d been with them just two years, had a natural inclination toward organization.

More importantly, he made systems exciting.

“People started coming to me saying, ‘I want to do what Kaleb’s doing. I don’t know what he’s doing, but it looks fun!'” Renee shares.

Some team members may lack skills needed for recovery execution. Others may resist changes necessary for improved performance. Building the right team sometimes requires difficult personnel decisions combined with intensive training for retained staff.

Performance measurement systems established during this phase should track leading indicators that predict future success. Don’t just monitor historical results.

Customer satisfaction scores, sales pipeline metrics, operational efficiency measures, and financial performance indicators provide early warning signals. These enable proactive management.

Phase 3: Growth and Optimization (Days 91+)

The final phase focuses on sustainable growth while continuously optimizing all business systems for improved performance.

This phase requires balancing growth investments with profitability requirements. You’ll build competitive advantages that prevent future crises.

Market repositioning strategies might involve expanding into adjacent customer segments. Develop new product lines that leverage existing capabilities. Create strategic partnerships that provide access to new markets or technologies.

The key is building on recovery success while avoiding overextension that could recreate cash flow problems.

The strongest competitive advantage often comes from operational excellence achieved through systematic thinking and documented processes.

Innovation pipeline development ensures continuous improvement in products, services, and business processes. This might involve formal research and development investments. Or systematic customer feedback processes. Or competitive intelligence that identifies market trends before they become mainstream.

Operational optimization should focus on scaling successful systems while eliminating remaining inefficiencies.

Technology investments that were delayed during crisis periods can now provide productivity improvements and customer experience enhancements. Quality improvements that were postponed can now strengthen competitive positioning.

Building competitive moats becomes the ultimate goal of successful turnaround efforts.

These might involve proprietary technology, exclusive partnerships, superior talent acquisition, or customer relationships that are difficult for competitors to replicate. The objective is creating sustainable advantages that prevent future competitive threats from becoming existential crises.

The strongest competitive advantage often comes from operational excellence achieved through systematic thinking and documented processes.

When companies can deliver consistent quality, predictable timelines, and reliable service while competitors struggle with inconsistent execution, they create market positions that are difficult to attack. This systematic reliability becomes particularly valuable during economic downturns when customers prioritize dependability over flashy features or aggressive pricing.

Frequently Asked Questions

Taking Action on Your Business Turnaround

A successful turnaround demands swift, decisive action paired with consistent execution over time. Waiting for perfect data or ideal conditions only accelerates decline. Struggling businesses don’t have that luxury.

Begin with an honest assessment of where you stand. Use the nine business killers as your guide to pinpoint the threats that endanger your survival most. Then, build a focused 90-day action plan to counter them: one with measurable goals, clear accountability, and regular progress reviews.

But remember: recovery isn’t just about fixing what’s broken. It’s about building lasting advantages that make your business stronger than before. Companies that master this process don’t just survive, they lead: because the discipline of recovery refines everything they do.

Your turnaround starts with commitment. Commit to systematic change, act decisively, and your business won’t just recover; it will redefine what success looks like.